Money Spartans Financial Group - Life Insurance Solutions

Life Insurance Is The Most Powerful Tool To Transfer Generational Wealth To Your Family.

About Us

Welcome To The Money Spartans Financial Group Insurance & Annuities Solutions

Where your peace of mind and financial security are our top priorities, offering personalized insurance solutions to protect what matters most:

Excellent Protection

High Savings Potenstial

Maximum Time Savings

Financial Literacy

We Instill Financial Peace Of Mind

& Hope For The Future

Death is heartbreaking as is, but even worse when families have to do a Go Fund Me or Fish Fry to raise money for funerals. That doesn’t have to be your story.

At The Money Spartans Financial Group, we help families protect what matters most: their loved ones. We do this by providing guidance about the proper type and amount of life insurance you should have.

Will Scott, Financial Services Broker, is on a mission to educate & protect the community. Since 2018, The Money Spartans have helped thousands of clients and we look forward to helping you as well.

Book a FREE call with us today to learn more about securing your legacy.

Things that everyone should know before buying life insurance

Before selecting a life insurance policy, your insurance advisor will likely conduct a comprehensive review of your financial situation, ask about your health history, and inquire about your long-term financial goals. They may also evaluate the following aspects:

Coverage Needs Assessment: Analyzing your current and future financial obligations, such as mortgage, education costs, and living expenses, to determine the appropriate amount of coverage.

Health and Lifestyle Review: Reviewing your medical history, lifestyle habits, and any pre-existing conditions to assess the risk and determine the premium rate.

Beneficiary Designation: Discussing your wishes regarding the designation of beneficiaries and ensuring that your policy aligns with your estate planning goals.

Policy Options and Riders: Exploring different types of policies, such as term or whole life insurance, and discussing any additional riders, like critical illness or disability coverage, that may enhance your protection.

Whole Life Insurance

🟩 Pros of Whole Life Insurance

1. Lifetime Coverage

Pro: Coverage lasts your entire life — as long as premiums are paid - Up to 100 years of age.

Why It Matters: Your beneficiaries are guaranteed a death benefit no matter when you pass away.

Use Case: Ideal for leaving a legacy, covering estate taxes, or ensuring final expenses are always handled.

2. Builds Cash Value

Pro: A portion of your premium goes into a cash value account that grows tax-deferred @ 2 to 3%

Why It Matters: You can access that cash through policy loans or withdrawals for emergencies, business opportunities, or retirement income.

Example: It’s like having a private savings account that grows even when the market dips.

3. Guaranteed Growth

Pro: The cash value grows at a guaranteed minimum rate, of 2 to 3% often supplemented by dividends (from mutual insurers).

Why It Matters: Provides stability compared to market-driven accounts like 401(k)s or IRAs — a key selling point for conservative investors.

4. Fixed Premiums

Pro: Premiums stay level for life — they never increase, even as you age or your health changes.

Why It Matters: Predictable payments make it easier to budget over the long term.

5. Access to Living Benefits

Pro: Many policies include living benefits riders that allow you to access part of the death benefit if diagnosed with a chronic, critical, or terminal illness.

Why It Matters: Clients can use their policy to cover medical or income gaps while still living.

6. Tax Advantages

Pro:

Cash value grows tax-deferred.

Policy loans are tax-free if structured properly.

Death benefits are income tax-free to beneficiaries.

Why It Matters: It’s a powerful wealth-transfer tool that helps protect family assets from taxation.

7. Estate Planning Power

Pro: Whole life is often used to fund trusts, pay estate taxes, or ensure smooth business succession.

Why It Matters: It helps clients create generational wealth.

🟥 Cons of Whole Life Insurance

1. Higher Premiums

Con: Whole life policies can cost 5–10x more than term life for the same death benefit.

Why It Matters: Not ideal for those needing maximum short-term protection on a tight budget.

2. Slow Cash Value Growth in Early Years

Con: It can take 5–10 years before the cash value builds meaningfully.

Why It Matters: Not suitable for those expecting quick returns or immediate liquidity.

3. Limited Investment Flexibility

Con: Growth is steady but not aggressive — tied to insurer dividends and guaranteed interest, not market performance.

Why It Matters: May not keep pace with inflation compared to market-linked options like Indexed Universal Life (IUL).

4. Policy Loans Must Be Managed Carefully

Con: If you take a loan and don’t repay it, it reduces your death benefit — and could cause tax issues if the policy lapses.

Why It Matters: Clients must understand how to use cash value strategically, not recklessly.

5. Surrender Charges and Fees

Con: Canceling the policy early can lead to surrender charges, especially within the first 10 years.

Why It Matters: Not ideal for someone who isn’t committed to long-term planning.

6. Complex Structure

Con: Whole life policies can be confusing — with dividends, riders, and policy loans to navigate.

Why It Matters: Requires education and trust-building between agent and client — but that’s where your expertise shines.

Term Life Insurance

🟩 Pros of Term Life Insurance

1. Affordable Premiums

Pro: Term life is the most cost-effective way to buy life insurance coverage.

Why: It provides pure protection (no savings or investment component), so you can get high coverage amounts for lower monthly costs.

Example: A healthy 35-year-old might pay $40/month for $500,000 in coverage.

2. Simple and Easy to Understand

Pro: Straightforward policy — pay a premium, get coverage for a set number of years (10, 20, 30, etc.).

Why It Matters: Ideal for first-time buyers, young families, or those wanting protection without complex investment terms.

3. High Coverage for Family Protection

Pro: Provides strong financial protection for your family’s needs (mortgage, income replacement, kids’ college, debt payoff).

Why It Matters: It ensures dependents can maintain their lifestyle and financial stability if you pass away prematurely.

4. Flexibility

Pro: Many term policies can be:

Renewed for another term.

Converted to a permanent policy (like Whole Life or IUL) without new medical exams.

Why It Matters: Offers flexibility if your needs or income change later.

5. Great for Temporary Financial Obligations

Pro: Perfect for covering time-bound goals — like protecting your family until:

* Your mortgage is paid off

* Your kids finish college

*You reach retirement age

🟥 Cons of Term Life Insurance

1. Expires Without Value

Con: If you outlive the policy term, coverage ends and you get no cash value back.

Why It Matters: You could pay premiums for decades and never receive a payout.

2. No Savings or Investment Component

Con: Term insurance only provides death benefit protection — it doesn’t build equity or cash value like Whole Life or Indexed Universal Life (IUL).

Why It Matters: You lose the opportunity for tax-deferred growth or using your policy for loans/retirement income.

3. Rising Costs at Renewal

Con: If you renew after your term expires, premiums can skyrocket due to age and health changes.

Example: A 30-year-old’s $25/month term policy might cost $150/month at age 50.

4. Limited Lifelong Coverage

Con: Term policies are designed for temporary needs — not lifetime financial planning.

Why It Matters: If you want to leave a legacy, fund estate costs, or cover final expenses at any age, you’ll need permanent coverage later.

5. No Living Benefits (Unless Added)

Con: Standard term policies don’t pay for chronic, critical, or terminal illness while you’re alive unless you add riders.

Why It Matters: Without these riders, you may miss out on access to funds when you need them most.

Indexed Universal Life (IUL)

🟩 Pros of Indexed Universal Life Insurance (IUL)

1. Lifetime Coverage

Pro: Like whole life, an IUL policy provides lifelong protection as long as premiums are paid and the policy stays funded up to 121 years of age.

Why It Matters: Beneficiaries are guaranteed a tax-free death benefit, giving clients both peace of mind and legacy security.

2. Market-Linked Cash Value Growth (with Downside Protection)

Pro: The cash value grows based on the performance of a stock market index (like the S&P 500) — without direct market participation.

Why It Matters: Clients can benefit from market-linked upside potential while being protected from losses if the market drops (thanks to a 0% or 1% floor).

Example: If the S&P 500 gains 8%, the policy might credit 8% (up to its cap). If it loses 12%, the policy might credit 0% — no loss to the cash value.

3. Tax-Advantaged Growth and Access

Pro:

Cash value grows tax-deferred.

Policy loans and withdrawals can be tax-free if structured properly.

Death benefits are income tax-free to beneficiaries.

Why It Matters: IULs act as a “tax-free retirement strategy” for clients seeking alternatives to 401(k)s and IRAs.

4. Flexible Premiums and Death Benefits

Pro: Unlike whole life, you can adjust premiums and death benefits within certain limits.

Why It Matters: This flexibility helps clients adapt as income changes — pay more during strong years, pause or reduce during lean years.

5. Access to Living Benefits

Pro: Most modern IULs include accelerated benefit riders for critical, chronic, or terminal illness.

Why It Matters: Clients can access a portion of their death benefit while still alive — protecting income and dignity during health crises.

6. Potential for High Long-Term Returns

Pro: With proper funding and index performance, IULs can outperform whole life’s fixed returns while maintaining safety from market downturns.

Why It Matters: Clients can grow wealth safely and strategically, combining protection and accumulation in one product.

7. Legacy and Estate Planning Advantages

Pro: Death benefits bypass probate and can be structured inside trusts for wealth transfer or estate liquidity.

Why It Matters: Fits perfectly into your Guardian of Legacy narrative of “Protect. Prosper. Pass It On.”

🟥 Cons of Indexed Universal Life Insurance (IUL)

1. Complex Structure

Con: IULs involve moving parts — caps, participation rates, cost of insurance, and crediting methods.

Why It Matters: Clients may misunderstand how growth or fees affect cash value unless properly educated.

2. Market Caps and Participation Limits

Con: The insurer sets a cap (e.g., 10%) and/or participation rate (e.g., 80%) on how much of the index gain is credited.

Why It Matters: Clients never get full market returns, which can limit growth in strong bull markets.

3. Requires Active Funding Discipline

Con: If the policy isn’t funded properly, costs of insurance can rise, causing the policy to underperform or lapse.

Why It Matters: It’s not a “set it and forget it” policy — needs periodic reviews.

4. Loan Mismanagement Risk

Con: Policy loans are tax-free only if the policy stays in force. If it lapses with a loan balance, that loan becomes taxable income.

Why It Matters: Clients must work with a trusted advisor (like you) to manage withdrawals safely.

5. Higher Fees Compared to Term Insurance

Con: Includes cost of insurance, administrative charges, and cap spreads that reduce credited growth.

Why It Matters: Not ideal for pure protection seekers — it’s best suited for clients looking for both protection and long-term tax-free accumulation.

6. Performance Depends on Interest Caps and Index Choices

Con: Changing market conditions and insurer adjustments can lower caps or participation rates.

Why It Matters: Policy growth can fluctuate year-to-year, even when markets are strong.

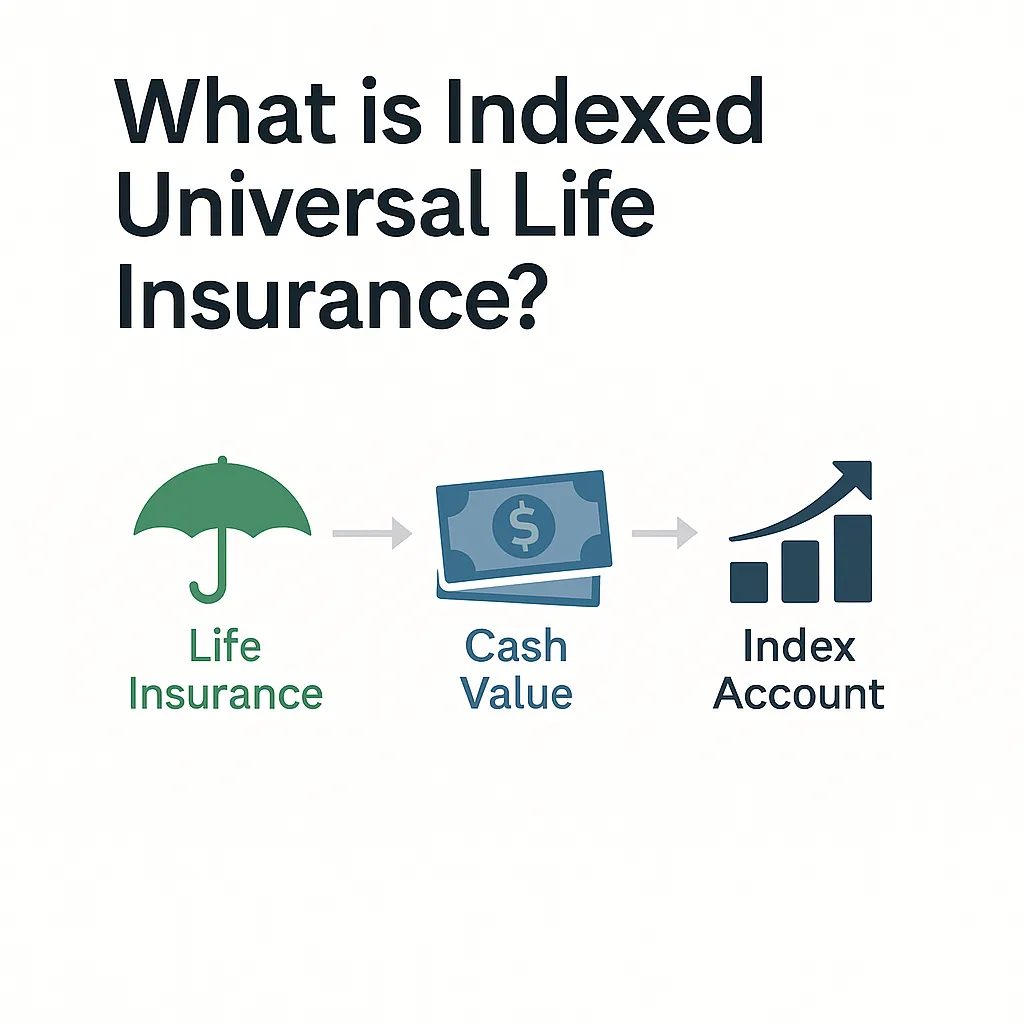

Final Expense/Burial Plans

🟩 Pros of Final Expense Life Insurance

1. Affordable, Predictable Premiums

Pro: Premiums are typically low and level for life, making it easy for seniors on fixed incomes to budget.

Why It Matters: Clients never have to worry about rising costs as they age or experience health changes.

Example: A 65-year-old might pay $50–$70/month for a $10,000–$25,000 policy.

2. Guaranteed Lifetime Coverage

Pro: Coverage never expires as long as premiums are paid.

Why It Matters: Provides lifelong protection for burial, cremation, or small debts — exactly when families need it most.

3. Simplified or Guaranteed Approval

Pro: Most final expense policies are simplified issue (few health questions, no medical exam) or guaranteed issue (no health questions at all).

Why It Matters: Perfect for older adults or those with health issues who may not qualify for traditional life insurance.

4. Quick Payout to Beneficiaries

Pro: Benefits are usually paid within days of claim approval.

Why It Matters: Families can pay for funeral and end-of-life costs immediately — avoiding financial stress or borrowing.

5. Flexible Use of Funds

Pro: Beneficiaries can use the payout for any purpose — not just funeral costs.

Examples: Medical bills, credit card debt, travel for family, or memorial expenses.

6. Peace of Mind for Loved Ones

Pro: Provides emotional relief knowing loved ones won’t be burdened with funeral costs or debt.

Why It Matters: It’s not just about money — it’s about dignity, closure, and legacy.

7. Small, Manageable Coverage Amounts

Pro: Policies usually range from $5,000 to $50,000, so clients can pick a benefit that fits their budget.

Why It Matters: Makes coverage accessible to nearly anyone who wants to plan responsibly.

🟥 Cons of Final Expense Life Insurance

1. Higher Cost per Dollar of Coverage

Con: Premiums are higher per $1,000 of coverage compared to term or larger whole life policies.

Why It Matters: Because the insurer knows they’ll likely pay out (given the older age of insureds), coverage costs more relative to benefit size.

2. Limited Death Benefit Amount

Con: Policies are designed for small face amounts — typically $10K–$25K.

Why It Matters: Not suitable for income replacement, mortgage protection, or legacy wealth building.

3. Two-Year Waiting Period (for Guaranteed Issue)

Con: Guaranteed-issue policies often have a 2-year graded benefit period, meaning if the insured dies (not by accident) within the first 24 months, only premiums plus interest are returned.

Why It Matters: It’s important to set the right expectations with clients upfront.

4. Slower Cash Value Growth

Con: Though some final expense policies build small cash value, growth is minimal.

Why It Matters: Not a wealth-building tool — it’s strictly protection-focused.

5. Limited Riders or Customization

Con: These plans don’t typically include advanced features like income riders or index-linked growth.

Why It Matters: Clients seeking living benefits or tax-advantaged cash value should look to IUL or whole life options.

6. May Not Keep Pace with Inflation

Con: A $15,000 policy today might not cover the full cost of a funeral 20 years from now.

Why It Matters: Clients should review coverage every few years or add inflation protection where available.

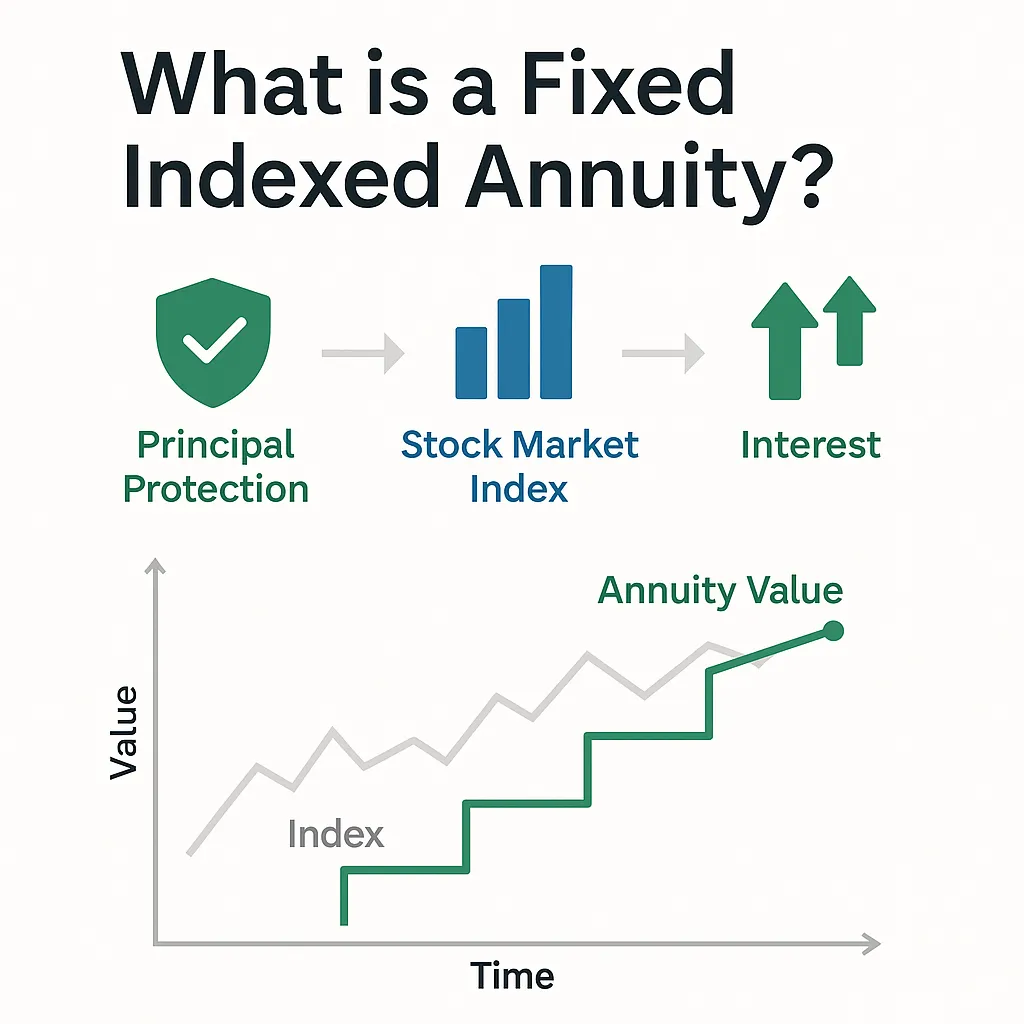

Indexed Annuities (IA) aka Fixed Indexed Annuity (FIA)

🟩 Pros of Indexed Annuities

1. Principal Protection

Pro: Your principal is protected from market losses.

Why It Matters: Even if the stock market crashes, your annuity’s value won’t drop due to market performance — it can only stay flat or increase.

Example: If the S&P 500 drops 20%, your credited interest might be 0%, but you don’t lose a penny of your original investment.

2. Potential for Market-Linked Growth

Pro: Earnings are tied to a stock market index (like the S&P 500 or Nasdaq 100), giving you growth potential greater than a fixed annuity.

Why It Matters: You can enjoy market-linked upside without the downside risk of direct investing.

Example: If the index gains 8% and your annuity has a 6% cap, you’re credited 6% interest — not 8%, but far better than a bank CD.

3. Tax-Deferred Growth

Pro: Earnings grow tax-deferred until withdrawn.

Why It Matters: Compounds your money faster, especially for clients who don’t need the funds immediately and want to supplement future retirement income.

4. Guaranteed Lifetime Income Options

Pro: With an income rider or annuitization, the annuity can provide guaranteed income for life — like a personal pension.

Why It Matters: Protects against running out of money in retirement, a top concern for retirees.

You can build “your own private pension plan.”

5. No Direct Stock Market Exposure

Pro: You don’t actually invest in stocks — you earn interest based on market performance.

Why It Matters: No worries about timing the market, volatility, or crashes affecting your savings.

6. Flexible Credit Strategies

Pro: Many indexed annuities let you choose from different crediting strategies — such as annual point-to-point, monthly average, or participation rate.

Why It Matters: Gives customization to match different financial goals and risk tolerances.

7. Optional Riders for Added Benefits

Pro: You can add riders for:

Lifetime income

Enhanced death benefit

Long-term care (LTC) or chronic illness benefits

Why It Matters: Tailors the policy to individual client needs and enhances long-term security.

8. Better Returns Than Fixed Annuities (Historically)

Pro: Indexed annuities often outperform traditional fixed annuities and CDs.

Why It Matters: Balances safety with opportunity — appealing to conservative investors seeking higher yields without risk.

🟥 Cons of Indexed Annuities

1. Caps, Spreads, and Participation Limits

Con: The insurance company limits your growth potential using caps (max return), spreads (deductions), or participation rates (you get a portion of index gains).

Why It Matters: You won’t capture full market growth, especially during strong bull markets.

2. Complexity

Con: Indexed annuities can be confusing, with multiple crediting options, fees, and riders.

Why It Matters: Clients need clear, transparent education — otherwise, misunderstandings lead to disappointment.

.

3. Surrender Charges and Limited Liquidity

Con: Most indexed annuities have surrender periods of 7–12 years, meaning you’ll pay penalties for early withdrawals.

Why It Matters: Not suitable for clients who might need quick access to large amounts of their money.

Example: You can typically withdraw only up to 10% per year penalty-free.

4. Potential for Low Returns in Flat Markets

Con: If the market has several years of low or flat performance, your credited interest could be near zero.

Why It Matters: While your principal is safe, inflation could erode your purchasing power over time.

5. Rider and Administrative Fees

Con: Optional income or long-term care riders can carry annual fees (0.8%–1.5% or more).

Why It Matters: These fees can reduce your effective returns if not used properly.

6. Taxable Withdrawals

Con: When you start withdrawing, earnings are taxed as ordinary income — not capital gains.

Why It Matters: Important for higher-income retirees to plan around.

7. Not Ideal for Short-Term Goals

Con: Indexed annuities are long-term contracts — typically designed for 5–20 years.

Why It Matters: They’re not for short-term investors or those needing liquidity before retirement.

Extra Note of Protection: Legal Insurance

We also offer affordable access to attorneys. You'll be surprised how often advice from an attorney can make a difference in your daily lives.

🟩 Pros of Legal Insurance

1. Affordable Access to Attorneys

Pro: Legal insurance provides access to licensed attorneys for a low monthly premium (typically $30–$60/month).

Why It Matters: Clients can receive legal help without the high hourly rates (often $250–$500/hr) that make many people avoid getting legal advice altogether.

Example: Reviewing a contract or writing a will could be free or heavily discounted under your plan.

2. Covers Common Legal Needs

Pro: Policies often cover everyday personal legal matters such as:

Will and trust preparation

Traffic violations and license issues

Tenant or landlord disputes

Employment or family law advice

Consumer protection and debt collection defense

Why It Matters: Reduces the stress of dealing with these legal challenges and helps clients act before small issues become major problems.

3. Prepaid & Predictable Costs

Pro: You pay a fixed monthly fee instead of unpredictable legal bills.

Why It Matters: Makes budgeting easy and ensures you always have help ready — similar to how health insurance protects you before emergencies happen.

4. Encourages Preventive Legal Action

Pro: Because help is prepaid, policyholders are more likely to seek advice early, avoiding costly mistakes later.

Example: Consulting an attorney before signing a business or lease agreement prevents future disputes.

5. Covers Your Household or Business

Pro: Some plans extend coverage to your spouse, dependents, or business entity.

Why It Matters: Great value for families or small-business owners who frequently need basic legal services.

6. Network of Experienced Attorneys

Pro: Most legal insurance providers have pre-vetted attorney networks.

Why It Matters: Ensures you’re working with qualified professionals — not scrambling to find one in an emergency.

7. 24/7 Consultation Hotlines

Pro: Many plans include unlimited phone consultations for legal questions.

Why It Matters: Offers instant peace of mind for quick legal concerns (e.g., traffic tickets, employment disputes, contract reviews).

🟥 Cons of Legal Insurance

1. Limited Coverage Scope

Con: Policies usually cover basic legal matters only.

Why It Matters: Serious or complex cases (e.g., criminal defense, major lawsuits, or real estate closings) may not be fully covered — only discounted.

2. Network Restrictions

Con: You often must use in-network attorneys to receive full benefits.

Why It Matters: If you have a preferred lawyer outside the network, you may get limited or no reimbursement.

3. Not Retroactive

Con: Legal insurance won’t cover issues that existed before the policy started.

Why It Matters: If you’re already facing a legal issue, you’ll have to pay out of pocket.

4. Caps and Limits

Con: Some plans limit the number of hours or case types covered per year.

Why It Matters: Clients with ongoing or complex legal needs may exceed their benefits quickly.

5. Quality and Responsiveness Can Vary

Con: Because some attorneys are compensated through group plans, service quality may vary depending on workload and network.

Why It Matters: Customer experience can differ between providers — plan reviews matter.

6. You May Not Use It Often

Con: If you rarely face legal situations, you might pay monthly premiums without much use.

Why It Matters: Legal insurance works best for proactive users, business owners, or families with regular legal questions.

7. Coverage Exclusions

Con: Most plans exclude:

Divorce or child custody battles

Criminal cases

Class actions or lawsuits involving multiple parties

Why It Matters: Clients should always read the policy fine print before assuming coverage

Frequently Asked Questions

What is life insurance, and how does it work?

Life insurance is a contract between you and an insurance company, where you pay regular premiums, and in return, the company provides a lump-sum payment, known as a death benefit, to your beneficiaries upon your passing. This payment can be used to cover expenses such as funeral costs, mortgage payments, and other financial needs.

How much life insurance coverage do I need?

The amount of life insurance you need depends on your financial obligations, such as mortgage payments, outstanding debts, future education costs, and your family's living expenses. A general rule of thumb is to have coverage that is 5-10 times your annual income, but this can vary based on individual circumstances.

Can I change my life insurance policy after purchasing it?

Yes, many life insurance policies offer flexibility. You may be able to adjust your coverage amount, convert a term policy to a whole life policy, or add riders for additional benefits. It's important to review your policy regularly and discuss any changes with your insurance advisor to ensure it continues to meet your needs.

Testimonials

I never realized how important life insurance was until my close friend experienced a sudden loss. It was perfect timing when I met Will. He came by my food truck and told me that he was a life insurance broker. I booked a meeting with him and the experience was nothing short of excellent. He was knowledgeable and compassionate, helping me navigate the process with ease. Now, I feel confident that my family won't face financial hardships in the event of the unexpected. It’s more than just a policy—it’s a promise to those I love.

Chauncey H.

My dad recommended Will Scott. I'm so glad I called him. It was the best decisions I've ever made. The peace of mind knowing that my family will be financially secure, no matter what happens, is invaluable. He was incredibly patient and took the time to explain all of my options, ensuring that I found the perfect policy to meet my needs. I can now focus on living my life to the fullest, knowing that my loved ones are protected.

Aliya B.

Come visit us

Get In Touch

Money Spartans Financial Group

Clark Tower Building

5100 Poplar Avenue

Suite 805

Memphis, TN 38137

Contact: (901) 485-7419

Email address: [email protected]

Hours

Mon – Fri 9:00am – 7:00pm

Saturday 12 noon - 6:00pm

Sunday – CLOSED